Udemy is an online learning platform for learners and instructors. The company had 1.37mn monthly average buyers in 4Q23. The platform helps learners to upgrade skills in an efficient and affordable way. Udemy operates two segments: Consumer and Enterprise. In 4Q23, the number of business customers reached 15,7k, up 13% YoY. The growth in the business segment demonstrated an impressive rate and has the potential to expand further. Affordability of education, large offering of courses in 75 languages, global support, interactive learning, personalized and immersive learning capabilities on data-driven with ML & AI platform, and instructor ratings are among the factors driving the popularity of the platform. The company completed its IPO at $29 per share in October 2021.

Udemy provides an online learning platform for teaching and learning. The Company offers over 210k courses from over 75k instructors on its learning platform in technical skills, business skills and personal development. The Company operates through two segments: Consumer and Enterprise. The company's courses can be accessed through its direct-to-consumer or Udemy Business (UB) offerings.

A changing work environment requires upskilling and reskilling workforce. The online educational platforms became an important element of the workforce reskilling during the pandemic, apart from offering personal development courses. According to Udemy, 84% of employers surveyed report COVID has increased the need to digitalize. The e-learning market opportunity is estimated at $166bn (2021) to grow to $476bn by 2027, including $69bn to $171bn growth of corporate learning. Key pillars of the online education model are quality, adaptability of content to swift market changes, the relevance of the content, and affordability. For organizations, online education provides analytics and insights, admin tools, customer support, and integration solutions.

- Udemy offers quality courses evaluated by independent learners with real-time ratings reflecting the quality of the content

- The content creators react to changing markets, adopting their courses

- Courses are taught by industry experts for real-world applications, representing relevant content for consumers

- Udemy offers free and affordable courses

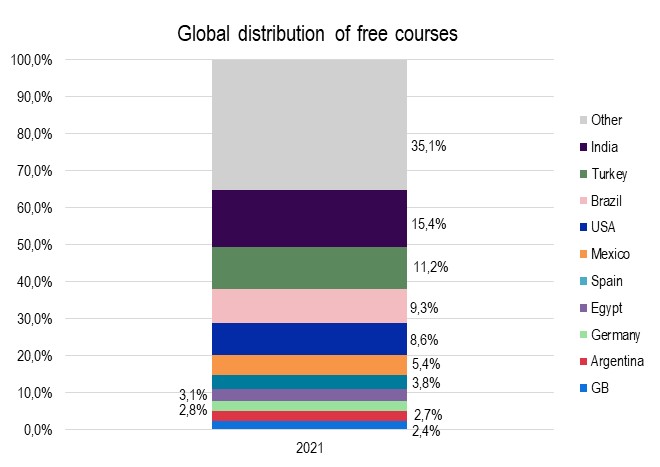

- Courses are offered in national languages

- Udemy uses ML & AI to offer relevant courses and offer comprehensive analytics & admin tools to enterprises

- The company demonstrated sustainable growth over the last years and operates one of the largest global platforms in terms of the number of users

- Exposure to a growing market in both Consumer and Enterprise segments

- Large geographical diversification benefiting from high demand for upskilling in emerging markets, including Asia and Latin America

- Udemy has a history of losses and may have insufficient revenue to achieve a breakeven

- The last results demonstrates a weak dynamics for Consumer segment revenue and user statistics that may indicate deceleration of growth

- The company operates in highly competitive segment and might be affected by the better positioning of other platforms

- The company relies on content producers which may change their preferences and leave the platform

- The user preferences may change between online and traditional forms of eduction

- Udemy's does not focus on diploma and certificates which might be preferable goals of learnings on other onine platforms

- Increaseing competition will negatively affect Udemy's business with less users and instructors coming to the platform

- Any loss of popular content creators will negatively affect the revenue stream

- Udemy operates with negative margin and may need to raise financing in the future

- The company may record deceleration of revenue growth, in particular in Consumer segment

- Intellectual property litigations, if any, related to the content on the plaatform may result in significat costs and adversely affect the business

| Company | RIC | Market Capitalization, $mn | Last reporting year | P/E Fwd 1Y | P/E Fwd 2Y | EV/EBITDA 1Y fwd | EV/EBITDA 2Y fwd | EV/Revenues 1y fwd | EV/Revenues 2y fwd |

|---|---|---|---|---|---|---|---|---|---|

| Udemy Inc | UDMY.O | 1,752 | 2023-12-31 | 452.2 | 47.5 | 89.9 | 24.5 | 1.6 | 1.4 |

| Chegg Inc | CHGG.N | 780 | 2023-12-31 | 6.7 | 6.4 | 5.6 | 5.3 | 1.5 | 1.5 |

| Coursera Inc | COUR.N | 2,208 | 2023-12-31 | 76.2 | 46.4 | 49.7 | 26.2 | 2.0 | 1.8 |

| Instructure Holdings Inc | INST.N | 3,078 | 2023-12-31 | 28.3 | 23.0 | 12.0 | 10.8 | 4.9 | 4.4 |

| PowerSchool Holdings Inc | PWSC.N | 4,234 | 2023-12-31 | 21.1 | 18.0 | 20.3 | 17.9 | 6.9 | 6.3 |

| 2U Inc | TWOU.OQ | 34 | 2023-12-31 | 8.0 | 7.1 | 6.0 | 1.1 | 1.0 |

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 276 | 430 | 518 | 629 | 729 | 794 | 853 | 929 |

| Growth | 56% | 21% | 21% | 16% | 9% | 7% | 9% | |

| EBITDA | -50 | -31 | -28 | -49 | 8 | 28 | 71 | 109 |

| EBITDA margin | -18.2% | -7.1% | -5.4% | -7.8% | 1.1% | 3.5% | 8.3% | 11.7% |

| Net income | -70 | -78 | -80 | -154 | -107 | -79 | -44 | -12 |

| Net margin | -25.2% | -18.1% | -15.4% | -24.5% | -14.7% | -9.9% | -5.2% | -1.3% |

| Net debt | -49 | -175 | -534 | -314 | -306 | -260 | -234 | -242 |

| MktCap | 2,685 | 1,523 | 1,523 | 1,523 | 1,523 | 1,523 |

Historical Multiples

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

|---|---|---|---|---|---|---|

| EV/Revenue | 4.2 | 1.9 | 1.7 | 1.6 | 1.5 | 1.4 |

| EV/EBITDA | -77.0 | -24.7 | 156.0 | 45.1 | 18.2 | 11.7 |

| P/E | -33.6 | -9.9 | -14.2 | -19.3 | -34.6 | -126.9 |